One of the biggest fears around getting divorced as a single mom is learning how to thrive financially. I was so scared about how to figure out how to provide for myself and my daughter on one income.

Downgrading my lifestyle was not something I wanted to do and I became very angry that I was being “forced” to do that. (I emphasized “forced” because it was my own inner belief system that caused me to feel this way.)

What became very apparent during this time of transition for me was that I had many limiting beliefs about money, abundance, and worthiness that came up. These beliefs blocked me from having what I desired and achieving the goals I set for myself. Identifying these along with doing the basics to manage my finances became the key for me to provide a beautiful home and life for myself and my daughter.

Thriving financially as a single mom is important for not only you, but your family.

After reading the basic fundamental ways to manage your finances, make sure you read all the way to the end to understand why you may not be thriving financially.

Here are the 8 foundational tips for thriving financially as a single mom:

- Get organized

The first step to taking control of your finances is to get organized. Gather up all your bills, bank statements, and credit card statements and put them in one place. This will give you a clear picture of where you stand financially. Understanding where your money needs to go and what you spend each month will help you get organized.

You may have allowed your spouse to take care of the finances and this may be your first time seeing everything clearly. When you see it all laid out in front of you, your fear may increase initially. In the long run, you will be in a much better position to create a thriving life for you and your children.

2. Make a budget

Once you know where you stand financially, you can start to make a budget. A budget will help you to track your spending and make sure that you are not spending more than you can afford. I know hearing the word budget may make you feel like you won’t be able to enjoy your life. The exact opposite happens.

Creating a budget allows you to direct where your money goes, what you save and invest, and how much to add in for pleasure and entertainment. Knowing where your money is going each and every month will help you thrive financially as a single mom.

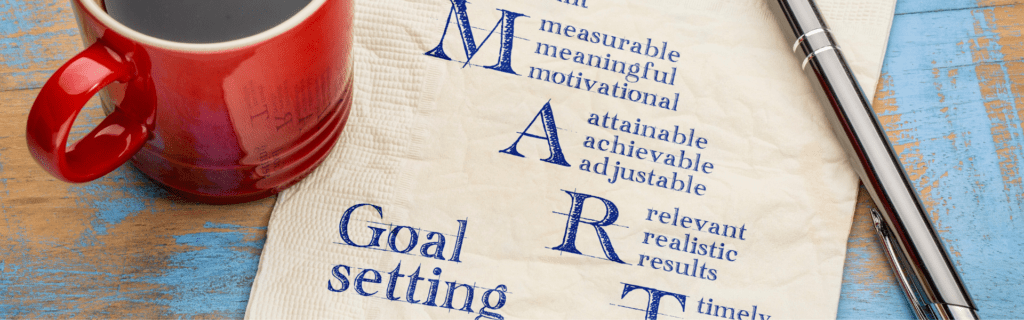

3. Set financial goals

Setting financial goals is an important part of taking control of your finances. Think about what you want to achieve financially in the short-term and long-term. Do you want to pay off your credit card debt? Save for a down payment on a house? Build up your emergency fund? Once you have set your goals, you can start working towards them.

I felt inspired when I finally decided to open an investment account for traveling. This will allow me to take trips that mean a lot to me that I want to share with my daughter. I had so much guilt around spending money for pleasure due to my own limiting beliefs around money and worthiness. Learning how to heal these beliefs is the key to being able to attract all that you desire and thriving financially.

4. Cut unnecessary expenses

One of the best ways to save money is to cut out unnecessary expenses. Take a close look at your budget and see where you can cut back on spending. This is not about the latte factor and skipping a latte everyday. If you enjoy having a latte every day, do it, but look at where you can cut back.

Do you really need that cable TV subscription? Could you cook at home more often instead of eating out? Are there any other expenses that you can eliminate?

Look for those hidden recurring fees or subscriptions that are on your credit cards. I didn’t realize I had been paying for Kindle on Amazon monthly until six months in. I had signed up to read a book during the trial period and forgot to cancel it before I was billed monthly. We have all made mistakes with money. It’s important to forgive yourself, learn from your mistakes, heal your money beliefs, and move on.

5. Boost your income

If saving money is not enough to reach your financial goals, then you may need to boost your income. One way to do this is to get a better paying job. Another way to boost your income is to make money through side hustles or passive income streams. There are countless ways to make money online today.

Find something that you enjoy doing and focus on it when you have some free time. Waking up a little earlier in the morning before your child or children wake up is a great time to focus on building new skill sets. This will allow you to create a side hustle or go get that promotion.

6. Invest in yourself

Investing in yourself is one of the best things that you can do for your financial future. Investing in yourself means taking steps to improve your education and job skills so that you can earn more money over time. It also means taking care of your health so that you can stay productive and earn an income for as long as possible. Whatever you need to do to continue learning and growing will help you become the best version of yourself.

7. Invest in assets

Another way to build wealth is to invest in assets such as stocks, real estate, or mutual funds. When done correctly, investing can provide you with a stream of passive income that can help you reach your financial goals quicker than if you only relied on saving money alone. This will allow you to thrive financially as a single mom. However, it’s important to remember that investing comes with risk, so be sure to do your research before making any investment decisions.

8. Live below your means

One of the best pieces of financial advice is to live below your means. This means spending less than you earn and investing the difference wisely. When you live below your means, it gives you the flexibility to save more money or invest more money without putting strain on your finances. Additionally, it can help protect you from financial difficulties if unexpected expenses come up or if there’s a drop in income.

Living below your means will allow you to make choices that are best for you. There are so many financial coaches or planners telling you what percentage you should be spending on housing, a car, entertainment, and food. However, you may decide to allocate more to one area that is most important to you.

Is having a nicer home in a good area of town more important than a brand new car? Do you value traveling over having a home with a mortgage so you choose to rent? Making choices allows us to have what we want and what is most in alignment with our own values. Obviously, you wouldn’t want to strap yourself with no wiggle room with a high mortgage, but it’s okay to look at what is most important at this time in your life.

These are the basic and tangible things that need to be addressed.

However, learning ways to heal your limiting beliefs around money, abundance, and worthiness, in my opinion, is the number one way to thrive financially as a single mom or for anyone.

9. HEALING YOUR LIMITING BELIEFS AND BLOCKS TO ABUNDANCE

These beliefs are usually unconscious, meaning you don’t walk around thinking these thoughts. They are hidden in your subconscious. Because they are hidden within, you are radiating this belief out into the world.

Let’s say you have a belief that you “can never get ahead.” You may see this show up as money coming in and you get excited, but then you get a bill in the mail for that exact amount. Or let’s say you have a belief that money is hard to make or get. You may think in your conscious mind that you want to be rich or make a million dollars. Yet, you have this belief within that “money is hard to come by” or “only a select few can make that kind of money.” With these beliefs in your subconscious, you will not be able to make the kind of money you dream about.

Here is a list of 10 common limiting beliefs about money:

- I don’t deserve abundance

- I’m not good enough/experienced enough for that job/career

- Money is hard to come by.

- I don’t have time (this was a big one for me. I felt overwhelmed and crazy busy working full-time and being a single mom. What I realized was that I needed to manage my time better. That meant not watching tv during the week or limiting it to once a week. I also made a list of what I valued most in my life and I only focus on those things that will bring me closer to achieving my dreams.)

- Change is too hard.

- I’ll never be successful

- I’m not good with money

- I don’t know how to manage a lot of money

- My family was poor and so I will be

- Something bad will happen if I have too much abundance

Do you any of these resonate with you? If so, learning how to heal and release these beliefs and blocks to abundance holds the key to unlocking a new path for your financial life. Check out this free e-book by Mary Morrisey, Breaking Through Your Hidden Blocks: Overcoming the 3 Biggest Barriers to Abundance. She spent years researching why she kept butting up against blocks to abundance and was able to turn her life around.

The single most important thing you can do, after going through your finances and having a clear picture, is to heal your blocks to abundance.

I know you want to thrive financially as a single mom and provide the best for your family because you and they deserve that. Don’t underestimate the power of doing the inner work to clear your path to creating all that you desire.

Wishing you so much love,